Life Insurance Plans for Expats Living Overseas

You may also have bought existence coverage in your private home united states, however in maximum cases, it won’t pay out in case you byskip away whilst dwelling overseas. That’s why you ought to remember worldwide existence coverage.

An worldwide existence coverage coverage is a settlement among you, the policyholder, and an coverage employer. On your end, you pay normal charges to the coverage employer. In exchange, the coverage employer can pay a economic gain to the beneficiaries you’ve decided on while you byskip away.

To say that existence coverage is an uncomfortable subject matter of verbal exchange for a few human beings is an understatement. Nobody desires to reflect onconsideration on death! However, understanding is power. The extra you understand how existence coverage works and the way it may gain your cherished ones, the extra cushty you’ll sense approximately this severe subject matter.

How Life Insurance Works for International Citizens

There are varieties of existence coverage: Term Life Insurance and Permanent or Whole Life Insurance.

International Term Life Insurance

Term existence coverage covers you for a set quantity of time or a “time period”, typically beginning at ten years. There are some of blessings for time period coverage. You aren't locked into one insurance quantity in your complete existence. There are frequently instances in existence while you want a massive quantity of coverage, like whilst your kids are younger and your loan is massive. Should you byskip away, you’d need to have good enough insurance to assist your developing own circle of relatives and cowl all money owed and fees of dwelling. But later in existence, whilst your home is paid off and your own circle of relatives is properly on their way, you could want much less insurance.

On the downside, as soon as your time period is over, your insurance is over too. For a few human beings, the concept of paying a coverage each month for ten years and getting not anything in go back doesn’t make economic sense (aleven though, of course, it’s an excellent component as you're nevertheless alive!) Other human beings fear that, if their fitness changes, they’ll be not able to resume their coverage whilst their time period expires.

Global Whole Life Insurance

For a few human beings, everlasting or entire existence coverage is a higher preference. In general, the charges are lots higher. However, you aren’t restrained with the aid of using the time period lengths. Once you’ve paid your charges, your buy is complete. Most everlasting existence coverage guidelines cowl you till you're properly into your older years. That said, it’s crucial to be aware that a few guidelines may also encompass a clause in which you get hold of fewer blessings while you’re older or that there are precise exclusions, which includes suicide.

Which Kind of Life Insurance is Best if You Are Living Overseas?

Statistically, maximum human beings are higher off financially buying time period coverage guidelines. The charges are reasonably-priced and with every time period, you could regulate the quantity of insurance you've got got in line with your needs. However, everlasting coverage is a higher preference for folks that are involved that their fitness may also alternate and they'd not be eligible for insurance at a destiny date. For instance, human beings who've a robust own circle of relatives records of coronary heart disorder may also worry that they may go through the identical destiny and can be ineligible for insurance whilst they're older. Even aleven though they will revel in super fitness today, their peace of thoughts is properly really well worth the fee distinction of everlasting coverage.

How Are Global Life Insurance Premiums Calculated?

Regardless of the coverage fashion you choose, your charges will depend upon how lots insurance you need, your age, your fitness, and different elements like whether or not or now no longer you’re a smoker. In general, ladies pay much less for existence coverage than guys primarily based totally on statistical projections in their fitness and lifestyle. And whilst it’s usually extra reasonably-priced to buy coverage while you’re younger, it’s a chunk of a fantasy that coverage charges skyrocket as soon as you switch forty. For maximum organizations, there isn’t a large distinction in coverage fees among folks that are 38 or 39 and people who're forty or 41. There’s no want to panic at the eve of a large birthday!

Insurance organizations will typically insist that candidates fill out a scientific records and, in a few cases, you could want a short scientific exam. There is typically no price for this exam, and it typically includes a nurse touring your private home to take your blood strain and a blood pattern.

How Much Coverage Will You Need?

Outdated fashions of existence coverage frequently throw round massive, spherical numbers like a million greenbacks because the minimal quantity of existence coverage that all of us needs. This one length suits all method is clearly vintage-fashioned! Life coverage is designed to cowl the own circle of relatives’s on the spot payments whilst a person passes away and assist ease the economic transition because the last own circle of relatives participants regulate to a brand new existence. There’s no person wide variety that’s ideal for each own circle of relatives.

In the quick time period, existence coverage ought to cowl end-of-existence care and the price of a funeral and permit surviving own circle of relatives participants to take a few day without work paintings to make vital preparations and adjustments. Life coverage preferably covers money owed like scholar loans and mortgages withinside the medium time period. As such, the last own circle of relatives participants will now no longer go through once they regulate to existence with one much less profits withinside the household.

In the lengthy time period, there are different economic considerations. For instance, if one associate earns notably extra than the different, the surviving associate’s lengthy-time period economic properly-being ought to be taken into account. Similarly, if one associate is a stay-at-domestic discern, households ought to calculate the fees of changing that person’s unpaid exertions ought to the worst happen. As such, persevering with charges that want to be covered, like a nanny’s salary, may also want to be factored right into a existence coverage coverage. Other households study how they could find the money for tuition, housing fees, and medical health insurance ought to the operating discern byskip away, whilst others element in fees like counseling and extraordinary varieties of assist.

How Much Does an International Life Insurance Plan Cost?

Premiums are normally primarily based totally on age and scientific records. The price of an worldwide existence coverage plan begins offevolved at as little as $10 according to month and could move up from there. Premiums will range with the aid of using age, quantity of coverage cowl, and different elements, which includes the coverage time period and the united states you're dwelling in. See a few instance fees for month-to-month existence coverage charges:

- A 45-12 months-vintage female (non-smoker) from the U.S. dwelling overseas in France

- 10-12 months Term Life Insurance coverage

- $400,000 Sum Insured

- $146 a month

- A 35-12 months-vintage male (non-smoker) from the U.S. dwelling overseas in Australia

- 10-12 months Term Life Insurance coverage

- $400,000 Sum Insured

- $seventy seven a month

Note: those are pattern rates. You can request a quote from William Russell and Unisure Group, leaders in international existence coverage and favored partners. As a 2nd option, you could request a quote from the Expatriate Group.

What Are the Best International Life Insurance Companies?

Finding a international existence coverage employer to cowl you whilst you're dwelling overseas isn't always as smooth as you'll expect. Insurance organizations base their insurance and pricing primarily based totally on precise demographic records utilized by their underwriters whilst reviewing and pricing guidelines. Because expatriates and worldwide residents come from extraordinary backgrounds and nations with extraordinary existence expectancies, scientific issues, and/or different elements, comparing new candidates from different nations is extra complicated.

You can touch a nearby coverage employer for your united states of citizenship to use for insurance earlier than you leave. Some of those organizations would require which you stay for your united states till the coverage is approved, ensure you practice 30 to 60 days earlier than leaving your private home united states.

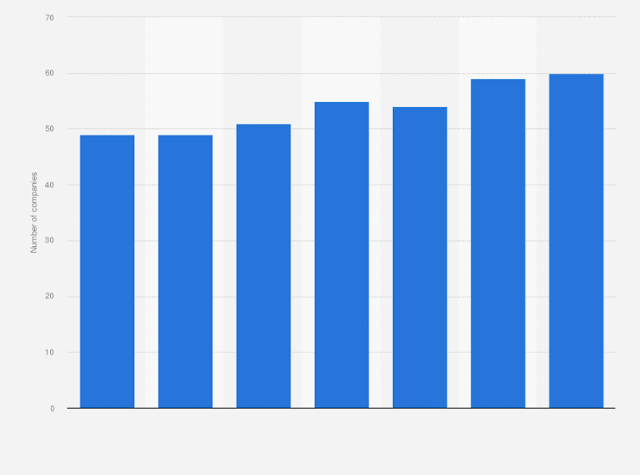

Top 10 Life Insurance Companies

According to IIE, those worldwide existence coverage organizations are the main insurers. Most of those are US-primarily based totally organizations protecting residents inside their united states of residence.

- MetLife Inc.

- Prudential Financial Inc.

- Equitable Holdings

- New York Life Insurance Group

- Massachusetts Mutual Life Insurance Co.

- Lincoln National Corp.

- Principal Financial Group Inc.

- American International Group (AIG)

- Jackson National Life Group

- Transamerica