Consecutive hobby charge rises during the last six months have hit debtors however the hidden sufferers of the coins charge spike were revealed.

The Finance Brokers Association of Australia say the ones who've lately been thru a wedding or dating breakdown are the hidden sufferers of the hovering coins charge as creditors will correctly reduce them off from having access to finance.

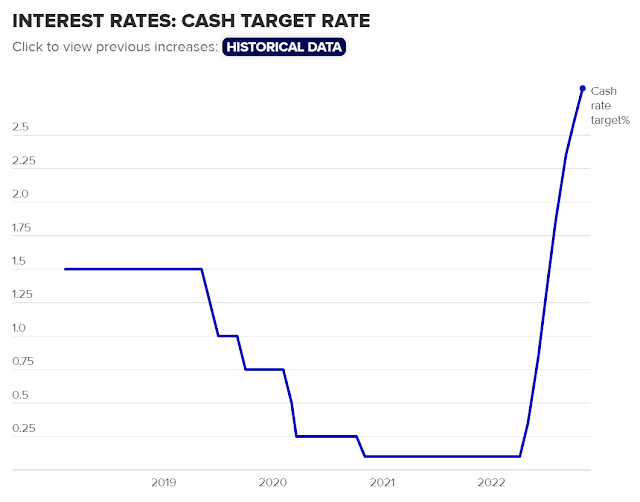

It comes because the Reserve Bank of Australia drove the coins charge up through 0.25 in line with cent on Tuesday bringing it to 2.60 in line with cent, with all Big Four banks shifting fast to byskip the hike directly to their domestic mortgage customers.

FBAA dealing with director Peter White stated human beings in those conditions are locating it "nearly impossible" to refinance or take out a brand new mortgage.

"It's constantly been a extra tough route for human beings on this state of affairs, however withinside the beyond it's been simpler for them to shop for out a belongings that become owned jointly, or refinance to begin a brand new life," he stated.

"But now banks are clearly rejecting programs outright, due totally to monetary troubles across the dating breakdown, and in spite of an applicant having an brilliant credit score records to that point."

It comes because the state-of-the-art hobby charge rise method debtors will see a astonishing hike to their mortgages while as compared to May. On an average $500,000 mortgage yesterday's selection led to an extra $seventy four a month or $687 for the reason that first growth in May.

White stated banks are not thinking about man or woman instances and the occasions round soliciting for to refinance or take out a brand new mortgage in spite of a few Australians present process the trauma of a dating breakdown.

"Relationship breakdowns are messy. Sometimes one accomplice makes choices that have an effect on the other, or the pressure of the state of affairs reasons scientific issues, or felony and relocation prices positioned monetary strain on a pair and payments fall behind," he stated.

"But clearly the Australian spirit of a honest cross ought to be prolonged to folks that deserve a risk to reposition their lives and circulate on from a tough state of affairs."

Mr White stated agents are supporting and a few have efficiently made the case for his or her customers to creditors, however the answer is for banks to alternate the manner they're making assessments.

"We recognize there are accountable lending standards, however that is no excuse for denying folks that meet those standards the possibility to begin once more through keeping a beyond condition in opposition to them forever," he stated.

"Banks can without difficulty amplify a few compassion as opposed to being pig-headed and making use of an overarching and rigid coverage for everyone."